Citi Account Not Found Register Again

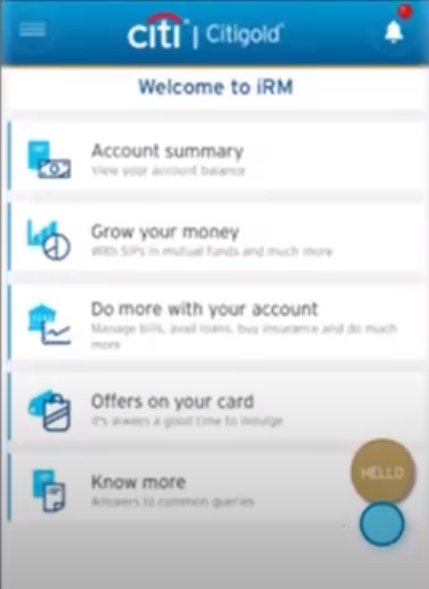

Citibank had provided new ways of banking for its customers via Citi Online and browser version of mobile banking. Later, the bank also rolled out a mobile application, Citi Mobile, that can make banking easier for its customers. The app offers a host of services to its retail customers with all the necessary security features built into it so the transactions are not compromised.

| Ownership Type | Private |

| CEO | Ashu Khullar |

| Headquarters | Mumbai |

| Customer Service | 1860 210 2484 |

| Founded | 8 October 1998 |

| Owner | Citigroup |

How to register for Citi Mobile services?

Step 1: Install the Citi Mobile app from the Google Play Store or Apple Store. Alternatively, you can send an SMS with the text 'MBANK' to 52484.

Step 2: Open the app and click on the 'New User' option below the 'Sign On' button.

Step 3: Select your account type—credit card account or general banking account from the dropdown menu. If you choose the first option, enter the card number, expiry date, CVV, and date of birth.

Step 4: You will receive an OTP on the registered mobile number. Enter the OTP received in the designated field and click 'Continue & Choose User ID'.

Step 5: Set up a user ID of your choice by entering it twice on the screen. Click 'Proceed To Choose IPIN'.

Step 6: Set up a 6-digit password for the user ID created in the previous step. Click 'Continue To Set Up Your 4-digit Card PIN'.

Step 7: Set up the 4-digit card PIN that is relevant for the credit card you have registered with the account. Click 'Continue'.

Step 8: You will see a success message on the screen.

How to log in to Citi Mobile app?

Step 1: Open the Citi Mobile app and enter your user ID and password. Click the 'Sign On' button.

Step 2: You will see the home screen of your account upon successfully logging in.

What are the services offered by Citi Mobile?

- View account details and transaction history.

- Transfer funds to another linked Citi account, another Citi account through NEFT and IMPS.

- Make utility bill and credit card payments.

- Open fixed, recurring, multi-, and tax-saver deposit accounts.

- Request for demand draft.

- Request for email statement, account linking, new chequebook, stop payment, and for a duplicate statement.

- Manage existing deposit accounts and edit maturity instructions.

- View credit card account details and transaction history, including the unbilled transactions.

- Convert credit card transactions into EMIs.

- The app is secure as the user ID and Internet PIN (IPIN) is necessary to log into the account.

- The user information is protected with 128-bit SSL protocol.

How to transfer funds on the Citi Mobile app?

Step 1: Open the app and log into your account by entering the user ID and password to view the home screen.

Step 2: Click on the three dashes at the top-left corner of the home screen, i.e. the menu symbol.

Step 3: If you have to add a new payee to transfer money, select 'Add a Payee' option. Otherwise, select one of the three transfer types—To my linked Citi account, To other Citi account, or To other bank accounts.

Step 4: If you continue with adding a payee, the following pop-up appears. Choose the desired option based on the payee's account.

Step 5: Add the payee details such as the account number and IFSC. Click 'Continue'.

Step 6: Review the payee details, agree to the terms and conditions by selecting the checkbox, and click 'Continue'.

Step 7: An OTP will be sent to your registered mobile number. Enter the OTP received.

Step 8: The payee details will be displayed to you with a success message. If you wish to transfer money to this payee, click the 'Pay Now' button.

Step 9: Enter the transfer amount and remarks. Choose the account from which you would like to transfer funds. Click 'Submit'.

Step 10: Review the transaction details. If the details are correct, click 'Confirm'.

Step 11: An OTP will be sent to your registered mobile number. Enter the OTP and click 'Continue'.

Step 12: A success message will be displayed after completing the transaction.

Frequently Asked Questions (FAQs)

Who can use Citi Mobile?

All current Citibank Suvidha/branch banking and credit card account holders can use Citi Mobile. However, the prerequisites for the facility is that you must have a handset with an active GPRS connection, an active IPIN used for Citibank Online, and mobile number registered with Citibank.

How do I get an IPIN?

In case you don't have an IPIN, visit the Online Self-Select to generate a new IPIN for the first time.

Can I forward the Citi Mobile download to my friend?

The download URL you receive after sending SMS to Citibank is valid for one-time use only. Ask your friend to follow the simple process of downloading the app using the method mentioned in Step 1 under the 'How to register for Citi Mobile services?' section.

Is it safe to log into my account from my friend's Citi Mobile app?

Logging into the Citi Mobile app is protected through IPIN. Also, the mobile phone, on which you log in, does not store any information you enter. Therefore, you can log into your account on any mobile device using your IPIN without having to worry about a data breach.

Invest in Direct Mutual Funds

Save taxes upto Rs 46,800, 0% commission

Source: https://cleartax.in/s/citibank-mobile-banking

0 Response to "Citi Account Not Found Register Again"

Post a Comment